In times of a sold-out real estate market, when there are multiple buyers for each property, those with money to spare often get priority. Some banks have responded to this need with a special mortgage product.

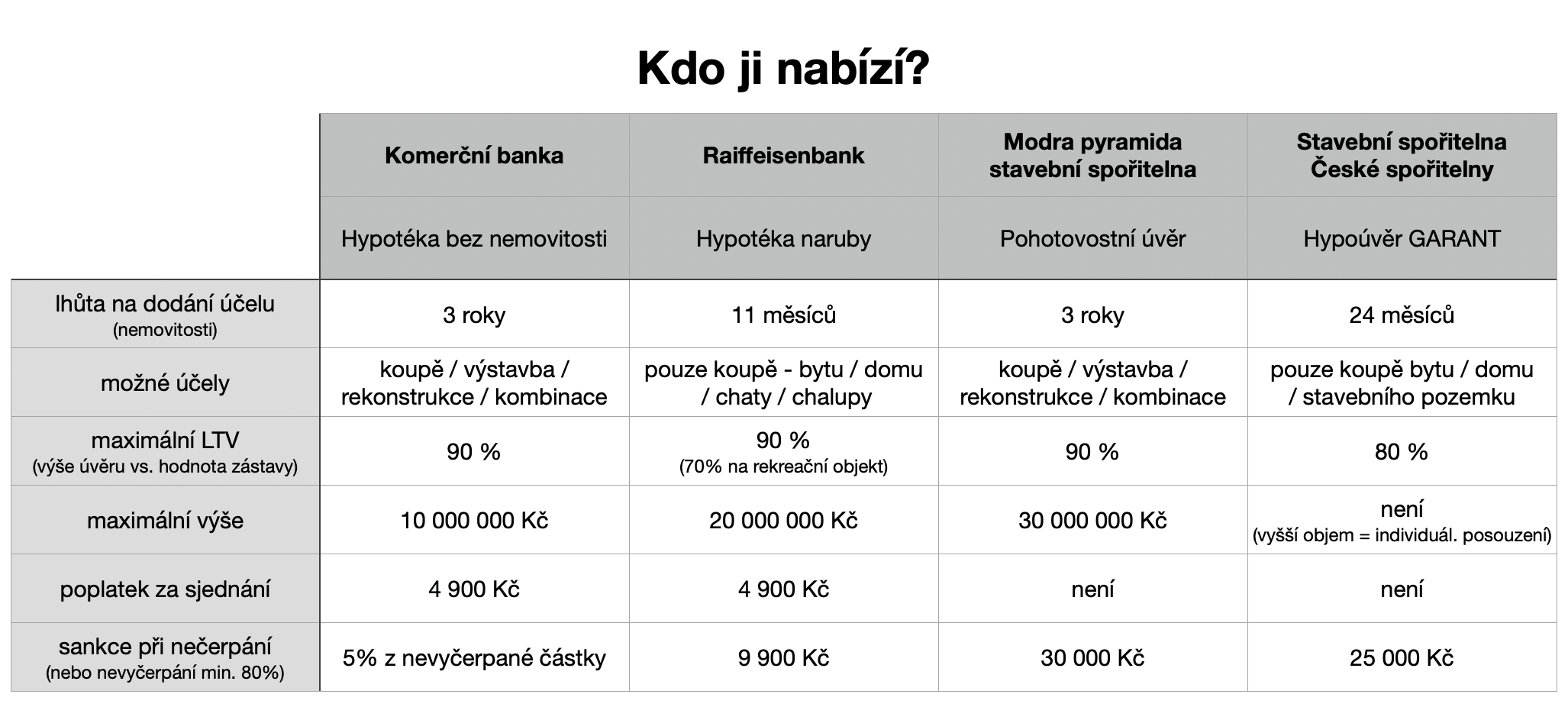

Mortgage without property, Mortgage inside out, Mortgage GARANT, Standby loan – these are the names of mortgage products that basically provide the same service.

This consists in providing the bank with documents to prove your ability to repay the mortgage and the loan is then approved only on the basis of these documents. In practice, you provide the bank with proof of income from your employment or tax returns and bank statements and tell them how much mortgage you would like. If the numbers match, the loan is approved in a few days and you can sign. Then you just deliver the property at the given time and live in it. It sounds simple and if everything works out as it should, this product can serve you well. However, it is not always a good idea to rush into such a mortgage. I’d almost say there are more cases where it’s not a good fit. So let’s break it down further.

What is it for?

The main purpose of this specialty is to provide security in the form of an approved mortgage. This comes in handy when you are looking for a property and you want to be the one who has the money ready and can react quickly to the offer and sign the reservation contract in peace.

If you know what you are looking for, know how much, have your own funds ready or another property to secure, then you are probably the ideal candidate for a mortgage without a property.

When does it come in handy?

- If there is a risk that you will not get a mortgage in the near future.

For example. the moment you are planning a family and one of your incomes drops in the coming months. But first calculate whether you can afford the mortgage in such a case. - When you plan to change jobs.

You are employed and about to go into business for yourself. Then a conventional mortgage would be unrealistic for you for at least another year. - At a time when interest rates are rising rapidly and you want to arrange a mortgage on the current more favourable terms.

However,inthis case, I recommend that you weigh up the balance between the potential savings and the commitment that a mortgage without a property represents.

When does it not fit?

- If you don’t already know what it’s going to be.

I may buy a house and I may also want to buy just the land and then build the house there. So this is a case where an upside down mortgage really doesn’t fit. - You have sufficient income and nothing is going to change anytime soon.

People are sometimes unnecessarily afraid of not getting a mortgage. Any capable financial advisor can do a basic scoring and assessment of whether a mortgage is realistic for you without obligation. And you don’t need to have a selected property to do so.

Risks

The main risk associated with a mortgage without a property is the chance of not taking out or not completing the mortgage. For example, you arrange a solution from Raiffka or Buřinka and then decide to build a house instead of buying a bigger apartment. Or you simply don’t manage to find a property in time. In this case, you will pay a penalty to the bank.

Likewise if you had your eyes wide open at the beginning and negotiated a high volume mortgage and eventually found something cheaper. You will pay the penalty even if you do not draw at least 80% of the loan amount (or leave more than 20%).

The opposite can also be the case. You take out a mortgage for 5 mil. CZK, but then you need 6 mil. CZK, because the price of real estate went up faster than you expected. This type of mortgage cannot be increased, so you need to get a good hit at the beginning. It is possible to arrange 6 miles. CZK and then draw only CZK 5 million. CZK (i.e. >80%), but not vice versa.

Another risk that people often don’t think about is the question of whether someone will finish with you. The advisor or banker receives his/her fee after signing the mortgage without the property. So if you take out a mortgage, consider whether the adviser or banker who started the mortgage will also complete it with you when you find the right home. It’s not just about making a guess. It is necessary to assess the contractual documentation, to set the conditions of drawdown correctly, etc. So with a mortgage, the other half of the work comes when we determine what it will be for.

Conclusion

The purpose of today’s article was not to promote a mortgage without a property, but not to discourage you from it either. He can be both a good servant and an evil master. After reading this, I believe you have a better idea of whether this mortgage is (un)suitable for you.

And if not, let’s have a good coffee together and discuss it.