To be approved for a mortgage, entrepreneurs must prove their income to the bank by submitting atax return (DP). However, the PDF alone is not sufficiently conclusive, which is why banks require:

- PDF tax return for the last one or two tax years.

- Bank statement from the month you paid the tax. If you are paying advance tax, you must also provide bank statements for all months in which the advance tax was paid.

- Confirmation of DP submission.

And it is this last point that we will address today. It is several ways in which you can submit a DP. So skip to the one that applies to you.

- I’m filing a paper DP

- I file my DP electronically via mojedane.cz (formerly EPO)

- I submit my DP electronically via data box

- My accountant files the DP for me

- What should I do if I have submitted the DP but no longer have the certificate?

I’m filing a paper DP

If you are old school and still file your tax return on paper, then stick to the following:

- Always print two complete copies including all attachments.

- Leave one copy at the tax office.

- You take the second copy back with the postmark of the tax office.

- Then scan and save all pages of the tax return as a PDF on your computer. You know, paper gets misplaced and then, like a dog, it gets eaten by a dog.

In principle ,I do not recommend sending your tax return by post. You will not get your copy back with a filing stamp.

I file my DP electronically via mojedane.cz (formerly EPO)

This method is probably the most practical. The tax portal will check for gross errors and also guide you and calculate what needs to be calculated.

- Download a PDF copy of your tax return from the portal and keep it.

- You can also download just a working version and consult it with a financial advisor before submitting.

- After filing your tax return, save the “Electronic Filing Confirmation Copy“.

I submit my DP via data box

If you are using accounting software, you are probably sending your tax return as an .xml file via a data box. In this case, think about:

- You also need to generate a PDF of the tax return from the accounting software and then submit this to the bank.

- Once you have sent your message, save the “Delivery Note” which will be available for download no later than the next working day. Download the delivery note in PDF and ZFO format.

- The receipt is only available in your mailbox for 90 days, so don’t forget it.

My accountant files my tax return for me

If your accountant comes to the tax office with a paper tax return, then the paragraph “I file my tax return on paper” applies.

If he/she submits it for you by logging into mojedane.cz or your data box using your access data, it is assumed that it is you and the previous two paragraphs apply.

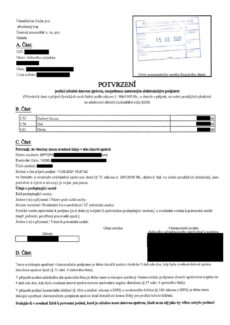

However, most accountants will file your tax return for you via their own data box. In this case, it depends on whether the relevant tax office has received a power of attorney allowing the accountant to represent you. If so, you only need a delivery note as in the previous paragraph. If not, the accountant will give you a “Confirmation of Filing Made by Data Message, …” whichyou must sign and take signed to the tax office within 5 days of filing. Then make two copies, one to leave at the filing office and one to take away with the postmark of the tax office. Scan this again for easier access.

What should I do if I have submitted the DP but no longer have the certificate?

Do not despair, you are not the first or the last. Ask your tax administrator at the tax office for a copy of the “A copy of the selected DAP data” or a direct copy of the submitted DP, which the tax office will stamp to verify its authenticity. Just count on the fact that the clerk has a 30-day deadline, so if you’re planning on a mortgage, it’s best to apply in advance.

Conclusion

Compared to mortgage applicants with income from employment, entrepreneurs have a slightly more demanding administration to prove their income. On the other hand, business income in relation to a mortgage can sometimes be “magic” as it offers more possibilities of interpretation and calculation.

Hopefully this article will help you in preparing for your mortgage. And if you want to see some of those aforementioned lines, you know what to do. 👇