It’s no secret that the inflation is at all time high. Investments are now virtually the only way to protect your money from depreciation and the best way to build up sufficient reserves over the long term.

However, it is also true that there are many pitfalls waiting for us in this world and we need to beware of various unfair practices.

Let me start by saying that I am a supporter of mostly value investing based on common sense. Simply, when I give money somewhere, it has to have a clear rationale and a plan in time. It is in this spirit that I approach my own investments and, even more so, the investments of my clients.

You can read where to invest below or watch the podcast (only in Czech). Here we will focus on important investment principles.

Podcast

Fundamentals of investing

Investment plan

Knowing why I am doing it and where I am going is necessary in perhaps any human activity. Whether you have a larger sum of money that you need to protect from inflation or draw an annuity from later, or you are just starting to build your wealth, whether or not you have a clear goal and a plan to achieve it will play a huge role in the matter.

So let’s take it one at a time.

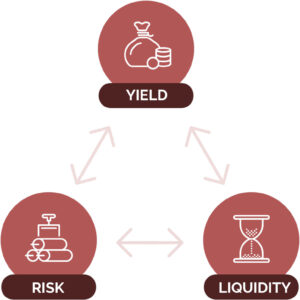

Yield vs. risk

If someone promises you a high return with no risk, calmly turn around and walk away. Such a man has more of his own interests in mind than yours.

In the investment world, the risk of downside or loss will always increase as the potential return increases.

A savings account poses a very minimal risk (bank failure), but its return will not exceed inflation by any stretch of the imagination. So the tax for this very low risk is the certainty that the money deposited loses value.

On the other hand, investments that outperform inflation over the long term carry associated risks. These risks are nothing to worry about or wake us up from our slumber. After all, in everyday life we often take more risks. When investing, however, it is crucial to know about them, understand them and set up an investment plan accordingly.

For the sake of simplicity, here are two main points to keep in mind.

Market risk

We all know this. For example, stocks and bonds are subject to market risk. Based on economic, geopolitical, or other conditions, stock prices either rise or fall. The important thing to note here is that if you are diversifying and thus investing in multiple global markets, then usually in the event of such a downturn you just wait for the price to climb back up. If you need to withdraw some money, you withdraw from assets that are not affected by the downturn.

Credit risk

This risk is particularly relevant for bonds. These have really taken off in the Czech Republic in recent years and are often sold as risk-free investments with guaranteed returns and a beautiful story. It’s a lie, of course! Be very careful of such. Credit risk means that if the issuer goes bankrupt (the company you lent to goes bust), you often lose your entire investment. Unfortunately, we have many such cases in the Czech Republic.

Investment horizon

By investment horizon, we mean the period of time we plan to leave the investment untouched. That is, the time during which we do not plan to collect the money. This does not mean that we lock the funds away somewhere without the possibility of partial or total withdrawal, but simply that we do not count on them for a given period of time.

Example 1

We’re a young couple, we have 2 millions CZK and we plan to buy our own home in Prague in 2-3 years.

So it is clear that we will need this money along with the mortgage to buy the property. The investment horizon is therefore 2-3 years. Logically, we will not buy stocks, precious metals or bitcoin. On the contrary, we will look for safer havens for this money with minimal risk, even at the cost that the money will slightly decrease in value due to inflation during that time.

Example 2

By selling the company, inheritance or a good year in business, I gained 5 million CZK. I have my own housing sorted out and I don’t expect any major expenses in the next few years.

This is an ideal case. Not everyone gets into such a situation, but those who do, then address the question of how to protect those funds from inflation, preferably to earn a little extra, but at the same time not make a decision that would lead to their loss. The great thing is that with this amount of money, we have more options. Just follow a few rules – diversify your portfolio according to investment instruments (stocks, bonds, real estate, alternatives, …) but also according to risk and horizon and don’t trust what looks too tempting.

Example 3

My spouse and I recently took out a mortgage. We are now settled in, have gotten used to the new monthly budget and now would like to start building up a reserve for future years. We have 200 thousand CZK saved and we are able to set aside 10 thousand CZK per month.

As in the previous example, it is good that there are no major expenditures on the horizon, so we have a longer investment horizon. Again, there is a need not to try to reinvent America and to stick to decades of proven investment tools. Then the investment will gradually snowball. We start with a small ball in the palm of our hand, but as the ball rolls and gets bigger, it packs more and more snow onto itself and grows exponentially. This is exactly the effect of compound interest.

Diversification, diversification, diversification!

In real estate, we hear “Location, location, location!”, or the fact that location is crucial in real estate prices. Similarly, diversification in investments. Putting all your money on one card is not investing, it’s a casino game where all your chips are on the black.

Whether your one card is Čez shares, Turkish bonds, silver or bitcoin…

Anything can see a drop or even go bust, which is why it doesn’t pay to have all your eggs in one basket – if you fall with it, you don’t eat.

However, investment diversification needs to be understood in a broader context. Buying shares of Apple and Microsoft on top of that meets the definition of diversification, but in reality it only solves the situation when one or the other company would not do well. However, in today’s globalised world, a political decision or a shortage of a component can affect the value of both these companies operating in the same market.

A great deal of diversification is offered by various mutual funds, whether we are talking about actively managed funds of global investment companies or passively managed funds (ETFs). Furthermore, the portfolio definitely includes other instruments such as real estate, bond funds, real estate funds. And if one is not a complete conservative, one can afford riskier investments (even speculation) in cryptocurrencies or precious metals, but in a healthy proportion to one’s overall wealth.

Liquidity

Liquidity = the ability to convert assets into money. With publicly traded stocks, you don’t have to worry about this topic at all. These will be converted into money in your account within a few days. For bonds, it depends on which market they are traded on. If private, then they are only liquid when you find a counterparty to buy them from you or wait for them to mature and hope that you have lent to a solvent entity. In general, we address the issue of liquidity primarily in relation to the investment horizon. If it is short and we may need to withdraw money suddenly, then we choose instruments with high liquidity. In the case of a long investment horizon, it does not matter if the investment is liquid within a few months. Maybe we don’t want to sell an investment apartment like this under a time crunch…

Conclusion

Investments are not difficult. The road to them has long been trodden and we all have access to investing. However, it is necessary not to be greedy and stick to the basic lessons:

- If something looks too good, I’ll triple-check it.

- If someone offers me a risk-free return, I walk away.

- I realize that “zero” risk also means certainty of loss of value due to inflation.

In times of prosperity, it is therefore necessary to invest and build up reserves. However, such provisioning cannot be done without a clear plan.

And it’s the drawing up of such an investment plan that is my area of expertise. So let’s discuss this over a good cup of coffee.