Let’s get two statements straight right off the bat:

1) I won’t live to see retirement!

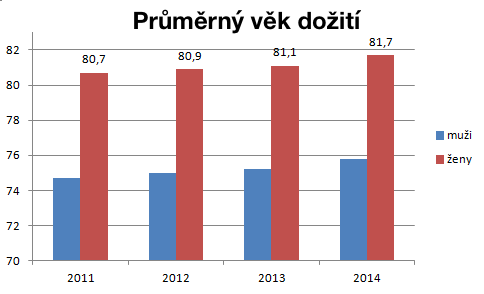

The current and probably the future government of the Czech Republic is trying to keep the retirement age at 65. So far, there is no indication that this will change. Whether we live to 65 or not depends, of course, on many circumstances. But in terms of statistics, in 2015-2016, the average life expectancy for women was 82 years, and for men it was 76 years. So most of us will actually live to age 65.

2) The state will take care of me!

Yes, we will get some pension. But will it be enough to live the last 15 years of our lives with dignity? Let us answer this question for ourselves. But if you’re reading this article, I’d say you’re in the clear.

Why should I prepare for retirement?

If you were not convinced by the introduction of this article, you will probably not be convinced by its continuation. Yes, in retirement we probably won’t have to pay the mortgage, the cost of cultural life will probably be a bit lower and our children will be able to take care of themselves. However, our income will also drop to about 60% and the costs for medicines, medical aids, nursing, etc. will rise.

How much should I save, when should I start and how much should I save per month?

In 2019, the average pension is CZK 13 319 per month. Can you imagine making ends meet with that amount every month?

I like numbers. They just don’t lie. So let’s answer the above questions very simply and in numbers.

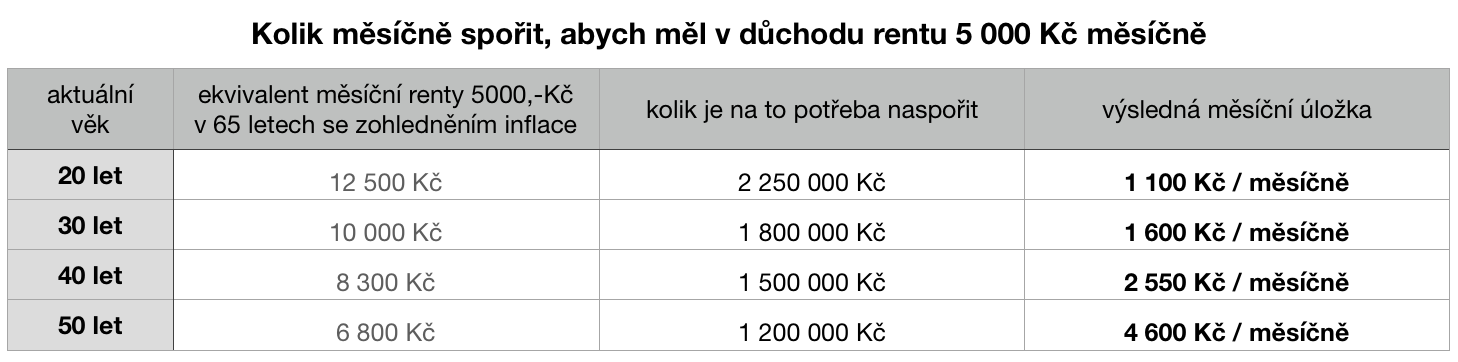

Let’s say that we would like to secure a second regular income of CZK 5,000 per month in addition to our pension for 15 years. The following table shows you how much you should save. It must also be said that today’s 5,000 CZK per month has a completely different value than it will have in 15-45 years (when we are 65 years old). For the calculation, we therefore take into account inflation of 2% according to the CNB’s long-term inflation target and the money appreciates on the capital markets at an average rate of 5% p.a.

Which financial product should I use?

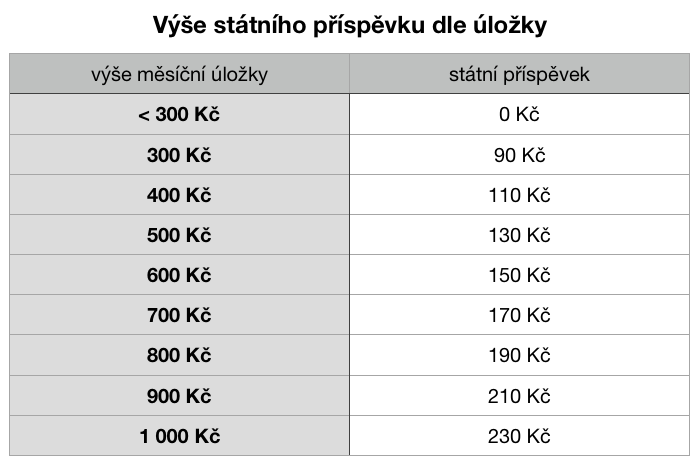

Definitely the first thing we should reach for is a pension! The state contributes to it, the employer can also contribute to it and we can deduct it from the tax base from the contribution >1000,-CZK/month.

There are two types of pensions:

If you set up your pension before 2013 and have not changed it, you have the so-called. The “old pension” or “Superannuation”, now also called the “Transformed Fund”. If you have set it up since 1. 1. 2013, you are the owner of a “new pension” or “Supplementary Pension Savings Plan”.

What is the difference between them?

The old pension card allows you to withdraw half of the saved funds after 15 years in the form of a so-called. Retirement pensions. It also guarantees that we will collect at least what we put into it + contributions from the state and employer. However, the Achilles heel of the old pensioner is his appreciation. Its average appreciation over the last 5 years ranges from 0.50% to 1.20% per year. If we factor in inflation, we find that the funds in this product tend to depreciate in value. So, in simple terms, it’s not exactly an ideal tool for preparing for retirement in the long term.

In contrast, the new pension scheme (Supplementary Pension Savings) offers an appreciation of funds on the capital markets. If you opt for it, you will lose the option of the Retirement Pension. Some pension companies offer a guarantee of the funds invested for an additional fee, but some offer it for free, and some do not offer it at all.

However, appreciation is what catapults Supplemental Retirement Savings to the best retirement preparation tool you’ll find on the market.

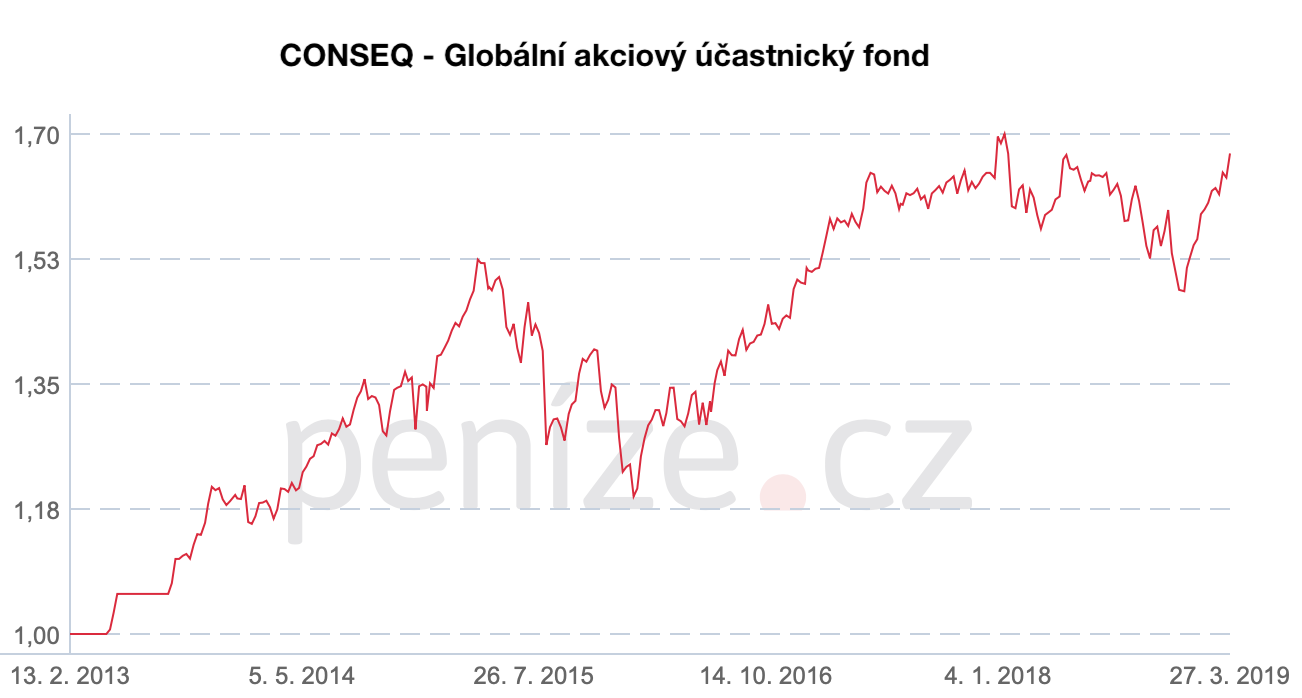

Conseq Pension Company, a.s. has been the best performer so far, with 67.47% of its Global Equity Participation Fund’s clients’ appreciation since its inception. That’s not bad at all in just over 6 years!

If you already have an old pension, you can switch to a new one for free.

The disadvantage (for some, perhaps the advantage) of the pension fund has always been that it can only be withdrawn at 60. year of age. If you take it out early, you will lose all government benefits. It is therefore not a highly liquid product. However, this makes it one of the few financial products where people actually save for retirement and don’t choose it on a whim.

Conclusion.

The main aim of this article was to show that we will live to see retirement, that we need to prepare for it and that it is better to start sooner than later. The Supplementary Pension Savings Plan is certainly a good tool to prepare for retirement. But as our grandmothers used to say, it is not good to put all the eggs in one basket. So be sure to consult with your financial advisor on the right allocation of your savings. At the very least, you should have one more product that is more liquid for when you need money to cover unplanned expenses.

If you would like to find out more or have a coffee with me for advice, I would be happy to hear from you at one of the contacts below.

Ask me about:

– What is pre-retirement and why is it better than early retirement?

– Why can’t the state or anyone else take money from my pension?

– What investment strategy should I choose?

– Is it better to have a pension with or without a guarantee? And why is that?

by Lukas Frank